S. Ultimate Judge denied so you’re able to lift a good stop for the package inside the later August Leave a comment

With this case, the new Missouri Attorneys Standard continues to put naked governmental notice and you can business avarice prior to education loan borrowers into the Missouri and across the country, Persis Yu, deputy government director and you will managing guidance into advocacy classification, told you from inside the a good Thursday statement.

Schelp supplied the states’ demand into Thursday, creating the administration try banned regarding size canceling college loans, forgiving people principal otherwise notice, not charging consumers accrued focus, otherwise next applying virtually any measures according to the (credit card debt relief agreements) or training government designers when planning on taking such as for example actions

This really is an uncomfortable attack into tens out-of scores of college student loan borrowers and you can our very own judicial program as a whole, Yu said. We are going to maybe not stop assaulting to expose these types of abuses and ensure borrowers have the relief it have earned.

By: Shauneen Miranda –

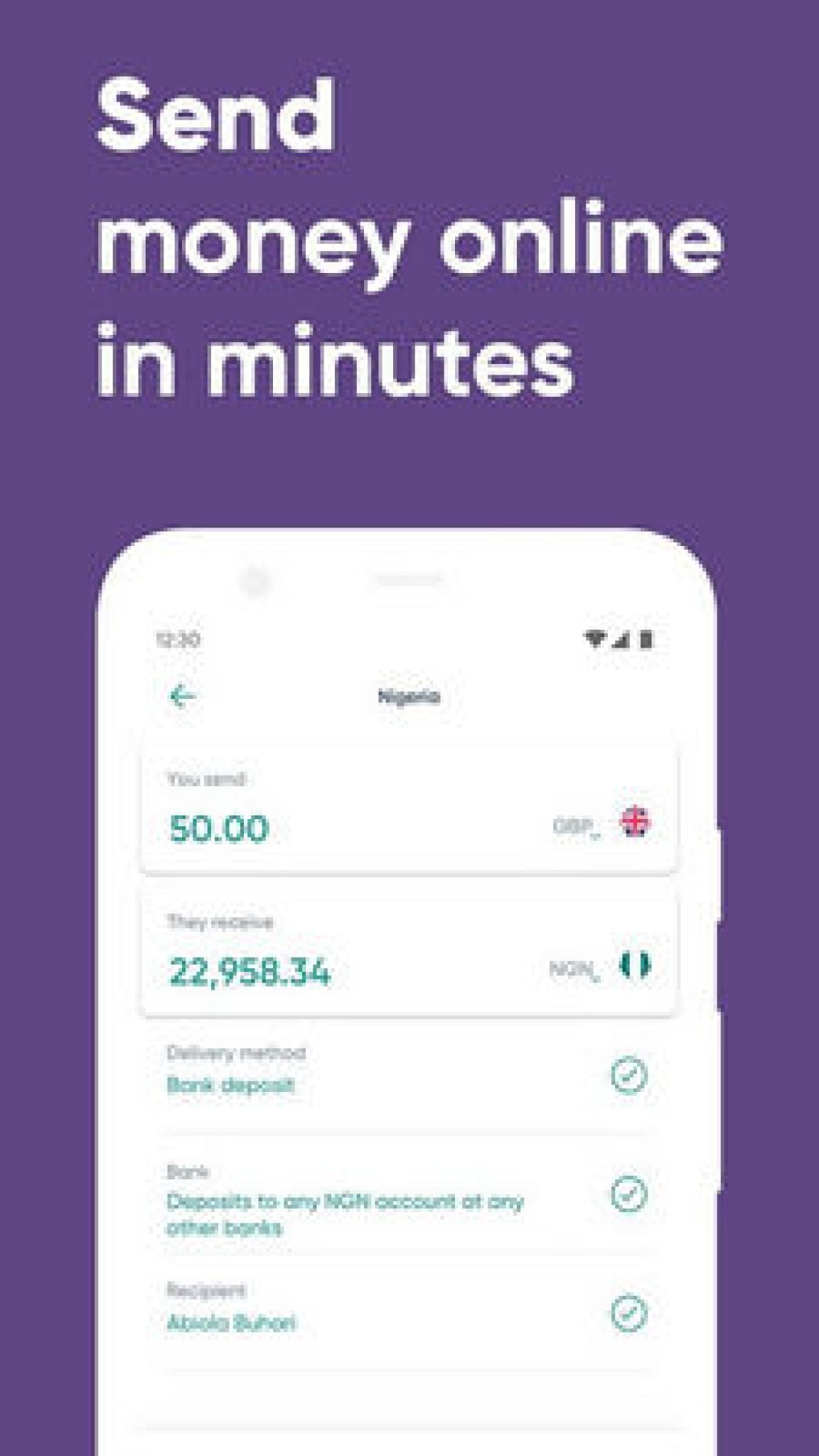

A Thursday governing within the federal courtroom for the Missouri after that prevents the administration’s services to market their focus on college loans ahead of new November election. (Photo by Getty Photo)

The latest governing next hinders this new administration’s jobs to promote their work towards student education loans ahead of the id persistent Republican pressures to Biden’s college student debt settlement efforts.

Brand new government, which revealed this new preparations within the April, told you these types of work would offer college student debt settlement to help you more 31 mil consumers. The fresh proposals was in fact never ever signed.

Their fit, submitted in an excellent Georgia federal judge, showed up just weeks after a special beginner credit card debt relief efforts – the fresh Saving into the a very important Education, or Cut, plan – always been put-on pause adopting the U.

Following the Sep submitting of your own match, You.S. Area Courtroom J. Randal Hall out of Georgia paused the plan due to a short-term restraining acquisition to the Sept. 5 and expanded that buy towards the Sept. 19 while the situation could be assessed.

However, into the Wednesday, Hall assist you to buy end, overlooked Georgia on the match and you can went the outcome to a great Missouri government courtroom.

Since match moved to Missouri and also the restraining buy is actually not stretched, the rest half a dozen says in the event easily tried a primary injunction.

Missouri Attorney General Andrew Bailey acknowledged Schelp’s decision, stating from inside the a good Thursday report on X that it is a beneficial grand winnings for visibility, the newest code off rules, and most of the Western just who need not base the bill for somebody else’s Ivy Group personal debt.

Meanwhile, a representative on Company off Knowledge told you the brand new department is extremely distressed from this ruling into our advised credit card debt relief laws, that have not even even already been finalized, for each and every a statement.

Which suit are introduced of the Republican elected officials exactly who clarified they will certainly stop at absolutely nothing to prevent an incredible number of her constituents out of taking respiration place to their student education loans, new representative said.

Brand new service usually consistently intensely guard such proposals from inside the legal and you will cannot avoid fighting to resolve the brand new damaged education loan program and provide service and you can relief so you’re able to borrowers across the country, they additional.

Using this type of case, the latest Missouri Attorneys Standard continues to lay naked governmental appeal and you will corporate avarice just before student loan individuals during the Missouri and around the the country, Persis Yu, deputy administrator manager and you can controlling guidance into the advocacy group, told you within the a Thursday statement.

Schelp provided brand new states’ consult into the Thursday, creating that the management was banned of mass canceling figuratively speaking, forgiving one dominating otherwise desire, not recharging read review consumers accrued desire, or next applying various other actions under the (debt settlement preparations) otherwise teaching federal contractors for taking for example strategies

This is an embarrassing attack on tens from many student financing borrowers and you can the official program general, Yu told you. We will maybe not prevent assaulting to reveal such violations and make certain consumers have the rescue they need.

Their match, filed in the a good Georgia federal judge, arrived simply weeks after an alternative beginner debt settlement energy – the newest Protecting on a valuable Training, otherwise Save your self, plan – continued to be apply stop adopting the You.

New service have a tendency to continue to strenuously defend these proposals in legal and you will will not stop assaulting to resolve the latest busted education loan system and supply service and you can recovery so you’re able to consumers nationwide, they added.