The basics: Chase HELOC Costs & Charge Leave a comment

Chase is actually a highly-known lender which provides a good HELOC product instead a loan application commission. However, there’s absolutely no Pursue house guarantee loan, and you need to spend a yearly restoration percentage towards the new HELOC.

Of a lot otherwise the people looked bring compensation in order to LendEDU. This type of profits try the way we look after the totally free service to have consumerspensation, along with instances out-of into the-depth article search, identifies where & how companies show up on the web site.

Pursue was a complete-provider bank, providing some products and services as well as bank account mortgages, playing cards, and private finance. The lending company is mainly based within the 1799 which can be one of many earliest banks regarding the U.S. as well as one of the largest banking companies in the country. Also, it is one of the primary domestic equity line of credit loan providers.

Domestic security personal lines of credit allow you to make use of this new collateral of your home to assist finance an enormous debts including once the do it yourself, debt consolidation, or scientific costs. An effective Pursue home security loan otherwise HELOC may help you do this with lower prices than just you might get that have credit cards and you will even specific signature loans.

Delivering an excellent Pursue HELOC

An excellent Pursue family guarantee line of credit allows you to tap to your guarantee you have manufactured in your residence, withdrawing a flexible amount of cash within realistic costs. Any HELOC serves similarly to a charge card that have an excellent revolving line of credit. You might use doing your restriction, which is based on your house well worth. And, as you create repayments, your free up the brand new borrowing. This enables one continue steadily to draw on your own residence’s really worth rather than trying to get a new loan.

Whenever applying for an excellent Chase family collateral personal line of credit, you are doing must meet the prerequisites. One standards include:

- Just about 80% loan-to-worth ratio

- A credit score with a minimum of 680

- DTI out-of only about fifty%

- Are now living in your house you happen to be playing with as collateral

While there are numerous exceptions to those requirementss, Chase will imagine her or him into an instance-by-circumstances basis. With the knowledge that you prefer apparently a good credit score and this you’ve make upwards sufficient equity of your house to do your targets is actually the biggest facts to consider because you progress.

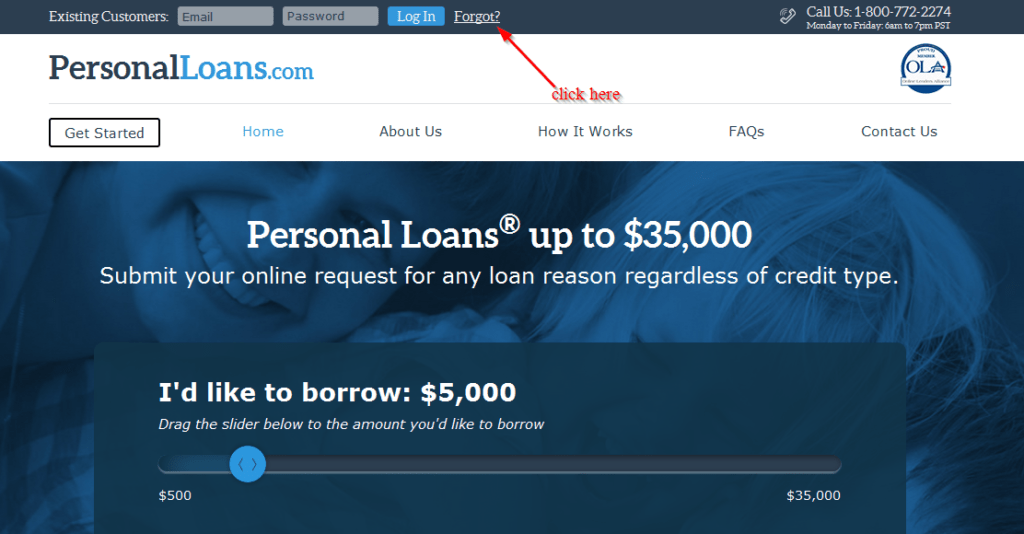

You could potentially make an application for an excellent Pursue domestic collateral credit line by entry a software online, contacting the borrowed funds hotline, otherwise because of the going into a great Chase part. Your render all papers wanted to prove the home’s worth, your earnings, and your borrowing from the bank. It will require regarding the forty five days to undergo the entire processes and personal on your own Pursue HELOC – although it usually takes a little bit stretched with regards to the state.

Pursue home collateral financing prices will vary considering individuals factors and your credit rating, how much your borrow, what you owe in your domestic, and you will where you’re discover.

There are even different details you need to know concerning terms of an excellent Chase domestic collateral credit line like the following:

- Fundamental Adjustable Annual percentage rate diversity: 5.75% to eight.14%

- Repaired Apr: One may option out-of a variable rate to a fixed Apr afterwards most of the or an element of the Pursue HELOC

- Borrowing limit: Relies on your own home’s really worth plus LTV ratio

- Software payment: $0

- Origination payment: $50

- Annual commission: $fifty

Contemplate, brand new Pursue domestic security financing rates and you may terminology you get have a tendency to count on your financial and borrowing disease plus house’s value.

The advantages

If you utilize a good Pursue household guarantee device, you are sure that that you will be getting entry to brand new endurance and expertise of a single of your own earliest and you may largest finance companies in the United states. As well, there private student loans without cosigner are positives which come whenever you are already good Chase consumer and you will also probably benefit from an income tax deduction when the you employ the fresh Chase HELOC getting renovations.