We do not require the interim financing getting lower than a specific number Leave a comment

Very, you are considering to find an alternative home with the Vancouver Isle, you need to offer your existing domestic basic. Do you know the possibility that times from attempting to sell your existing domestic and buying the new house make? Whilst it really does takes place, it all depends towards the several products in addition to: new collection quantities of belongings from inside the Deeper Victoria, your finances and you can what you are looking for (we.elizabeth. a single relatives, condo, townhome or duplex). In case the housing market is sensuous, you happen to be contending with people and you will settling times that actually work to you could make their offer reduced appealing to the latest suppliers.

Plus if you discover your brand-new house, promoting your existing household takes longer than you expect

When you are in times where you require the money in the income of one’s latest where you can find purchase your 2nd home, you’ll find possibilities eg at the mercy of the fresh new profit of your property also provides or meantime financing.

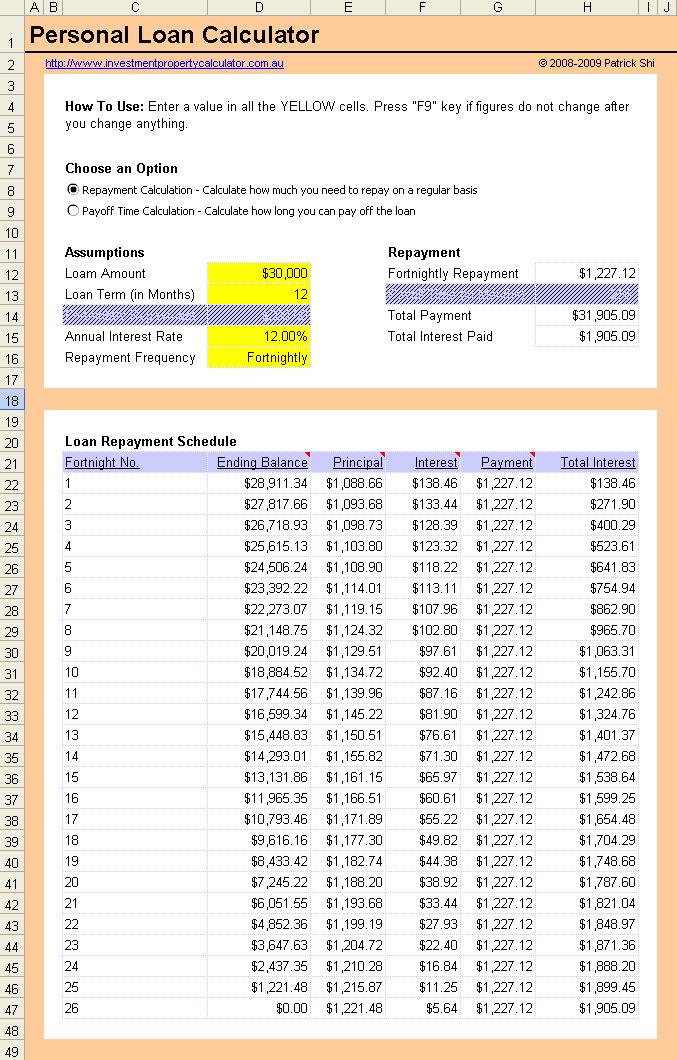

What is connection investment? Link resource is actually a primary-label resource tool. It will help home buyers in order to bridge this new gap ranging from a vintage and you can the fresh financial, by permitting them to tap into new collateral inside their most recent household once the a down-payment, while you are generally getting several features simultaneously while they wait for revenue of the existing the home of personal.

- The financial institution will require a strong agreement (deal off buy) toward assets brand new debtor is actually attempting to sell to help you explore the latest security out of that property once the a down payment with the new home they wish to get. This may mean every standards should be eliminated to the the house or property he’s to acquire as well as the you to definitely he’s selling.

- Organization lenders often favor their connection finance is shorter, and you will something more $500,100 manage generally speaking require a difference. For a different accepted, it does depend on the covenant. They are going to like to see well-purchasing, stable a job, very strong Beacon Scores, reasonable unsecured debt, an such like. Or no of those covenants aren’t top notch, you are in danger having brand new connection money fall due to.

- On top of that, really institutional lenders limit the bridge financing name in order to thirty days. Organization loan providers usually offer bridge financing at the prime +2% and you can charge a little handling percentage.

Will link investment does not work because you can not be comfortable putting your home on the market unless you discover you have got located your upcoming domestic. Unfortunately, lining up new time off an accepted give on the house youre offering on home youre buying are going to be problematic.

However, there are many other options getting homebuyers who want so you can promote its newest the home of fund the acquisition of their the fresh new household.

Interim funding generally speaking is the particular financing generated whenever a contract can be obtained towards purchase of the newest house, nevertheless current house has not yet ended up selling.

Considering Duncan Gardner, a large financial company having High Pacific Mortgage & Expenditures inside Victoria, BC; extremely highest banks, borrowing unions and other organization lenders carry out an extremely specific kind of off connection capital, even so they provides a very clear standards for what they undertake

Because an exclusive bank, we mortgage all of our loans away that have a more prominent-feel method, says Duncan. Do not wanted a firm arrangement on latest property. We don’t require meantime bridge to-be thirty days otherwise quicker. His business now offers an alternative solution once the an ago-right up plan.

When the a person owns their most recent family outright (or which have a tiny home loan), in addition to overall financing to well worth among them properties is actually under 70 in order to 75%, we are able to provide them with interim funding, demonstrates to you Duncan. Our rates are not excessive more than the banks, our very own fees aren’t larger than some one would feel whenever getting an enthusiastic covered financial, and we also may even potentially are interested set aside integrated into the borrowed funds, so our very own clients don’t need to make month-to-month focus money, the other financing are simply just pulled immediately after their residence deal.

Palatine payday loans no credit check

If you’re personal lenders could be a tad bit more pricey, whenever you are attempting to buy your second domestic one which just promote your current home, meantime capital as a result of a personal lender is something you might need to have in-line. It just might possibly be exactly why are moving into your brand-new dream family it is possible to.

If you have questions regarding buying and selling a residential property, whether it’s a flat, waterfront family, otherwise travel property home near Victoria, BC, just Contact us the audience is here to assist.