FHA Thinking-Sufficiency Calculator | 3-cuatro product qualities Leave a comment

Material

A keen FHA mortgage is a good selection for resource the acquisition out-of a multi-equipment property. But not, 3-4 tool qualities need to be thinking-enough, which means that they have to keeps a positive income.

Read this article to learn about FHA’s notice-sufficiency conditions and choose up several methods for raising the chances your three to four-device property need was mind-adequate. Following, explore our very own FHA Care about-Sufficiency Calculator to perform some recent tests.

What is the notice-sufficiency attempt having FHA fund?

FHA’s worry about-sufficiency sample requires that the local rental money out of a 3-cuatro unit talks about the property’s expenses, such as the casing percentage. Which sample implies that the home generates sufficient lease getting a sound financial support and that you tends to make the mortgage costs or other personal debt.

To pass brand new self-sufficiency decide to try, the online leasing money toward assets must be equivalent to otherwise more than the new PITI.

- Disgusting local rental income is the full month-to-month rent generated by every this new equipment, like the you to definitely might live-in, prior to deducting any expenses.

- Websites leasing earnings is actually 75% of your terrible leasing earnings.

- PITI represents dominant, attract, fees, and insurance rates. The fresh month-to-month homes fee boasts the borrowed funds, property taxes, homeowner’s and you will financial insurance, and you can connection fees.

What if you want to shop for a great three-device possessions, reside in one to equipment, and rent out the other a couple. The following methods will help you to guess the latest property’s cashflow.

- Add the estimated lease for everybody three devices to find the terrible rental money. Were book toward equipment it is possible to entertain.

- Multiply the latest gross local rental income of the 75% to obtain the internet leasing income.

- Subtract the fresh new PITI from the net leasing money to choose if the property features a positive otherwise negative income.

To take and pass the new mind-sufficiency attempt, the house or property have to have confident income. This means, the net leasing money need equal otherwise surpass the PITI.

Just how do lenders calculate FHA’s Online Worry about-Sufficiency Leasing Money?

Loan providers utilize the Web Notice-Sufficiency Leasing Money (NSSRI) algorithm to determine whether or not a purchaser have enough money for pick and manage an excellent 3-cuatro unit assets having a keen FHA home loan.

- Calculate the latest month-to-month houses fee, PITI. (Home loan Calculator)

- Calculate this new month-to-month websites leasing income. Make use of the possessions appraiser’s advice out-of reasonable markets lease from every gadgets, in addition to your personal. Up coming subtract twenty five% or even the vacancy grounds provided by this new appraiser, whatever are greater.

- Determine if the house or property is actually worry about-adequate. New PITI separated because of the web rental earnings are in the really 100 percent.

FHA Thinking-Sufficiency Calculator

https://paydayloanflorida.net/pinecrest/

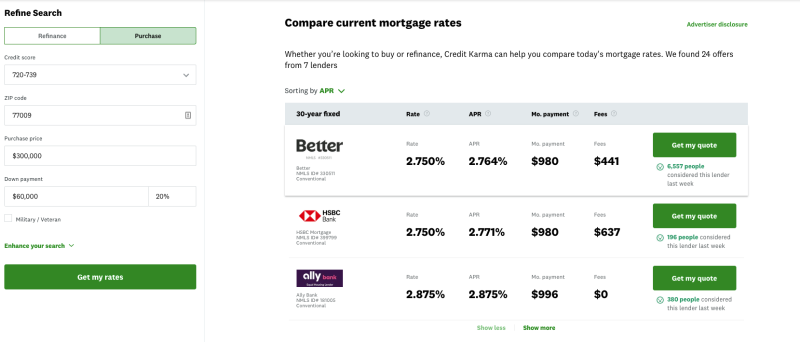

Select most recent FHA cost, payments, and you may closing costs. Get the details to know what to anticipate when purchasing good 3-4 unit assets.

Ahead of offe band to get a good three- otherwise four-equipment property, make your best effort to determine whether the assets features a confident earnings. Choosing a skilled lender and you can realtor and you will talking to them helps you build told behavior and steer clear of possible facts together with your financial app.

Earliest, score a proven home loan pre-approval page from a mortgage lender. Affirmed is more credible than just unverified pre-approvals regarding large banking companies and you will internet sites loan providers. Instance, within NewCastle Lenders, an authorized mortgage underwriter exactly who helps to make the latest financing choice studies your own borrowing and you will financial information initial. That way, you feel confident on purchasing a multi-tool home.

Second, apply at a realtor. An excellent buyer’s broker helps you imagine local rental income for an excellent multi-device possessions from the researching comparable rents.

Regarding a specific multi-unit assets, followup along with your bank. The lending company calculates the monthly construction payment, analyzes the new leasing income prospective, and screening the fresh property’s mind-sufficiency.

You will find most recent costs, money, and closing costs into the webpages 24/7-availableness information when it’s needed really when planning on taking advantageous asset of every opportunities.

What are my selection when an excellent 3-4 device possessions goes wrong FHA’s self-sufficiency shot?

Get a hold of a separate possessions. If for example the possessions does not meet FHA’s conditions and is maybe not economically practical, think finding a different sort of property that meets disregard the desires and funding standards.

Use another mortgage program. Antique mortgage loans don’t require a self-sufficiency try. But not, they might require a larger down-payment and restriction the latest leasing earnings you can use in order to qualify for the loan.

Improve the leasing earnings. Remark the fresh new appraiser’s thoughts out-of reasonable sector lease on the assessment declaration and you will evaluate they into the a house agent’s search. In the event the appraiser overlooked equivalent rents, inquire the financial institution to examine your own agent’s market study or support documentation. That have supporting records, the lending company is notice the latest appraisal, increase the net rental earnings, and you can approve the loan.

Slow down the PITI . Remark the newest property’s expenses and look for an easy way to cure all of them. Like, lessen the loan amount, get a hold of a less expensive homeowner’s insurance company, or decrease the financial interest rate.