Ways to get A beneficial USDA Financing Which have Bad credit

Indeed there are not of numerous homebuyers available to you having the bucks easily accessible to get a house downright, that’s the reason most of them turn to mortgage loans. Yet not, lenders usually require consumers to have above a specific credit rating in order to decrease the possibility of the latest debtor defaulting. This doesn’t indicate that in the event that you keeps poor credit you to you are away from chance. You may still find specific loan choices available that you might be eligible for despite their less than perfect credit, such as the USDA financing.

Brief Breakdown of USDA Loan

The USDA loan try an authorities-recognized financing provided by the U.S. Institution from Agriculture (USDA). It absolutely was established as a way to prompt home buyers so you can purchase assets in more rural and you may residential district regions of the world, and thus assisting to give and you will boost the savings in addition to lifestyle in those section. Several of the advantages to taking out fully a good USDA mortgage are the latest zero downpayment requirement and also the reduced-interest levels.

Brand of USDA Mortgage System

There have been two brand of USDA money: USDA guaranteed loans and direct money. The difference between the 2 is dependent on the method that you have the mortgage in addition to earnings level standards of each and every mortgage.

Mortgage Pledges And requires

USDA secured fund operate in a comparable fashion to other authorities-backed financing, instance FHA funds and you will Va fund: the USDA means the mortgage, although loan is received as a consequence of a participating lender. The lender tend to normally settle down its standards for qualification given that mortgage try backed by the fresh USDA. That it eliminates the threat of taking a loss when your borrower non-payments to them.

Regardless of the USDA’s support, there are still plenty of criteria that must definitely be satisfied. In addition to showing that you will be good U.S. citizen otherwise long lasting citizen, the brand new projected payment per month for your home (and prominent, focus, insurance policies, and you may taxes) can not cost more than 30 percent of your month-to-month money. Virtually any monthly costs you only pay can’t surpass 41 per cent of the earnings. not, there clearly was some independency–should your credit score is higher than 680, then they often imagine large financial obligation percentages.

There are numerous earnings limitations as well. The feet earnings limit need to be less than 115 % from brand new area’s average money. There are even several home earnings constraints you should fulfill. Having children having five or less some body, your loved ones money can not be more than $82,700. To have property having five to 8 members, it can’t be more than just $109,150. In the end, the home have to be most of your home.

Lead Finance And requirements

If the income was reduced or suprisingly low, which is determined by the money tolerance situated by USDA for direct USDA funds (hence differs from an area to another), then you may be eligible for a primary USDA mortgage. This is why the latest USDA tend to procedure the borrowed funds to you cashadvanceamerica.net loan places open on sunday truly, not as a consequence of a lender. Through the use of subsidies, your USDA loan’s interest is as absolutely nothing as one per cent.

A lot of the conditions are the same having a direct mortgage once the good USDA guaranteed financing; but not, you can find differences, mainly in terms of the income limitations. The beds base income limitation was anywhere between fifty and you can 80 % from the newest area’s median money. The family income limitation so that you can five-user domiciles are $50,a hundred. For five to 8-associate home, it’s $66,150.

Do-it-yourself Financing And you will Gives

Why are new USDA mortgage particularly novel is that it generally does not simply have to be studied on acquisition of a property. USDA finance can applied for to cover the can cost you regarding renovations otherwise fixes. The new USDA brings gives and fund for your do it yourself one to takes away safety and health potential risks otherwise advances access to.

Máy in Laser Canon LBP8100N

2 × 17.000.000 ₫

Máy in Laser Canon LBP8100N

2 × 17.000.000 ₫  Máy in Brother HL-L8360CDW

2 × 11.000.000 ₫

Máy in Brother HL-L8360CDW

2 × 11.000.000 ₫  Máy in đa chức năng HP Color LaserJet Pro M181fw (T6B71A)

2 × 8.750.000 ₫

Máy in đa chức năng HP Color LaserJet Pro M181fw (T6B71A)

2 × 8.750.000 ₫  Máy in Laser Canon LBP 351X

1 × 30.000.000 ₫

Máy in Laser Canon LBP 351X

1 × 30.000.000 ₫  MÁY SCAN CANON DR-F120

1 × 8.500.000 ₫

MÁY SCAN CANON DR-F120

1 × 8.500.000 ₫  Máy scan Fujitsu fi - 7140

1 × 17.190.000 ₫

Máy scan Fujitsu fi - 7140

1 × 17.190.000 ₫  Brother MFC-L3750Cdw (In đảo mặt/ Copy/ Scan/ Fax + WiFi)

1 × 12.900.000 ₫

Brother MFC-L3750Cdw (In đảo mặt/ Copy/ Scan/ Fax + WiFi)

1 × 12.900.000 ₫  MÁY IN LASER CANON LBP 5970 - KHỔ A3

1 × 60.000.000 ₫

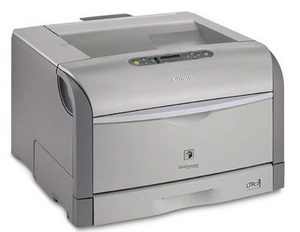

MÁY IN LASER CANON LBP 5970 - KHỔ A3

1 × 60.000.000 ₫  MÁY IN ĐA CHỨC NĂNG HP LASERJET MFP M236DW

2 × 5.690.000 ₫

MÁY IN ĐA CHỨC NĂNG HP LASERJET MFP M236DW

2 × 5.690.000 ₫  Máy in đa chức năng HP LaserJet Pro M28w (W2G55A)

1 × 3.590.000 ₫

Máy in đa chức năng HP LaserJet Pro M28w (W2G55A)

1 × 3.590.000 ₫  PC HP 285 Pro G6 MT (Ryzen 7 4700G/8GB RAM/256GB SSD/WL+BT/K+M/Win 10) (320A8PA)

1 × 14.350.000 ₫

PC HP 285 Pro G6 MT (Ryzen 7 4700G/8GB RAM/256GB SSD/WL+BT/K+M/Win 10) (320A8PA)

1 × 14.350.000 ₫  Mực in Brother TN-451Y

1 × 1.500.000 ₫

Mực in Brother TN-451Y

1 × 1.500.000 ₫