How come the new FHA financing cost calculator functions? Leave a comment

The new FHA financing system helps make home ownership far more sensible for almost all homeowners. Although this should not be thought a keen FHA mortgage certification calculator, house affordability out of an excellent lender’s view comes with a beneficial borrower’s debt-to-money (DTI) ratio. With respect to the homebuyer’s credit history or other functions, FHA finance can be acknowledged which have a DTI as the high due to the fact 50%. The FHA affordability calculator makes you examine various projected home values having fun with different DTI percentages predicated on your income and you will monthly personal debt costs.

Updating the brand new DTI always determine the estimated domestic funds have a tendency to alter the estimated monthly payment and you can recalculate the mandatory FHA off fee. FHA loan standards possess a minimum advance payment of step three.5% of your own residence’s cost. To be able to pay the FHA advance payment is as important given that appointment new monthly FHA payment obligation. The results found suggest an excellent 3.5% down payment. So you can try out huge off payments in addition to their effect on monthly FHA home loan repayments, have fun with our FHA online calculator.

FHA financing value should also account fully for the new FHA mortgage insurance coverage premium. FHA money are around for too many homeowners since the FHA handles the loan financial in case of standard. Therefore, a portion of every FHA mortgage fee goes toward insuring the fresh new financing. That it mortgage cost (MIP) normally rather feeling cost. FHA MIP on the a great $250,000 house is as much as $170 30 days. Based on your revenue, FHA MIP you will affect your DTI sufficient to think a lower life expectancy price.

What will be my DTI feel?

Everyone, loved ones, and you will homebuyer varies. There isn’t any DTI that works for all, apart from to state that down is better. Folks, family relations, and you may homebuyer differs. There’s absolutely no DTI that actually works for all, apart from to declare that down is perfect. Whilst not devote brick, the brand new roadmap centered by the FHA is a great starting point.

31 identifies their construction ratio, which is just their complete recommended month-to-month household payment (prominent + desire + FHA MIP + possessions taxes + homeowners insurance) and additionally monthly HOA fees divided by your disgusting month-to-month income. With a housing ratio (lenders label which your side-stop proportion) regarding lower than 30% isnt required, but it’s a standard to take on when deciding your spending budget.

The new 43 inside the will be your DTI (lenders call it back-end) proportion. Its everything you as part of the 30% along with your total monthly obligations repayments. More debt there is the huge this new gap between the casing ratio and you will DTI. Having side-stop and back-stop percentages that will be comparable function you’ve got addressed your debt better.

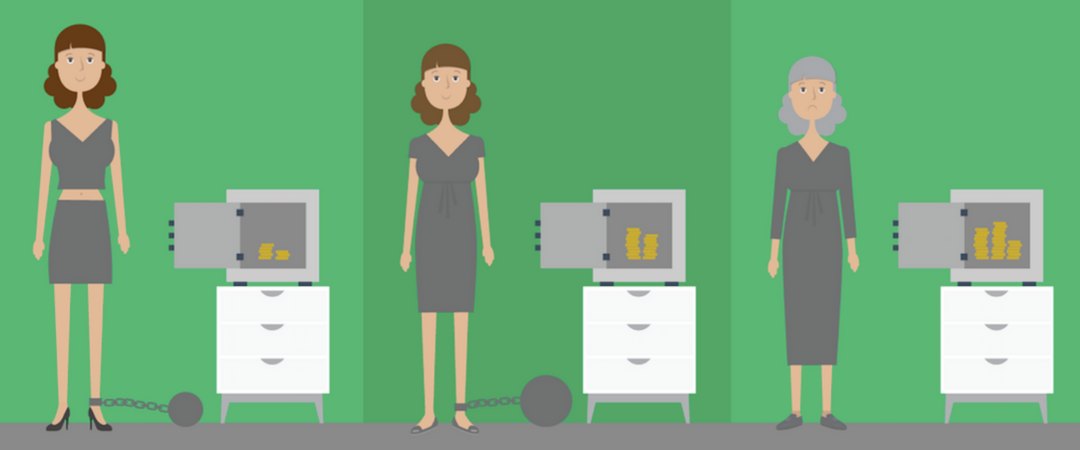

In relation to your own DTI, you will need to see your financial updates and never use a firm DTI profile. An enormous family members with thousands of dollars of monthly childcare expenses is almost certainly not offered that have a great thirty five% DTI mortgage repayment, while you are a single person lifestyle a modest lifetime could possibly get easily be capable of handling you to definitely at the forty%. The newest percentage and you can house funds computed making use of the FHA affordability calculator would be utilized as helpful information. Take into account the complete photo, with the DTI, lifestyle, monthly payments, and you can all else, when determining the new domestic budget.

FHA Home loan Rates & Cost

FHA financial costs are over the years reduced, but what really does which means that to have FHA homebuyers? The rate into the home financing privately affects this new payment per month. The greater the pace, the greater the mortgage percentage. Yet not, the speed cannot impact the commission and you can cost as frequently all together may think. Such, an elementary 31-year financial getting $100,000 having an excellent cuatro% rate of interest possess a primary including attract percentage off $. Decreasing the rate to three.875% alter new commission in order to $. That is $eight.19 per month. While shopping for a reduced home loan speed is essential, brief activity inside the interest rates are certain to get a reduced influence on FHA financing cost.

Can there be a keen FHA financial maximum?

FHA financing limits are different based and therefore condition and you may condition you are buying. Very areas across the country make use of the FHA base mortgage restrict to select the limit FHA mortgage dollar amount. A property rates above the condition loan restriction need a more impressive down payment versus minimal 3.5%.You can find parts of the country where a home opinions is actually high, and you can FHA accounts for such counties by the improving the FHA mortgage limitation. Understanding the FHA maximum what your location is lookin could save you time and cash. In the event your funds exceeds what FHA it payday loans without bank account in Haleyville allows into the a given urban area, you will need to think a conventional loan.